sacramento tax rate calculator

The table below shows state and county tax rates for each of the 58 counties in California as well as the combined state county and city income taxes for. What is the sales tax rate in Sacramento California.

How To Calculate Taxable Income H R Block

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sales Tax Table For Sacramento County California. All are public governing bodies managed by elected or appointed officers.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Revenue and Taxation Code Sections 6051 6201. Our Sacramento County Property Tax Calculator can estimate your property taxes based on similar properties.

Census Bureau American Community Survey 2006-2010 The Tax Foundation. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County California. The County sales tax rate is.

Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. Your household income location filing status and number of personal exemptions.

What is the sales tax rate in Sacramento California. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

Sales Tax for Sacramento CA. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too. Choose the Sales Tax Rate from the drop-down list.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. To calculate the sales tax amount for all other values use our sales tax calculator above. Tax Collection and Licensing.

The Sacramento sales tax rate is. Discover Helpful Information And Resources On Taxes From AARP. This calculator does not figure tax for Form 540 2EZ.

Please visit our State of Emergency Tax Relief page for additional information. Ad Avalara can help you with global item classification tax calculation filing and more. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax.

The California sales tax rate is currently. Make international tax compliance simpler through automation with Avalara. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period.

You can find more tax rates and allowances for Sacramento and California in the 2022 California Tax Tables. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. View the E-Prop-Tax page for more information.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The combined tax rate of 875 consists of the California sales tax rate at 6 the Sacramento County sales tax rate. Online Services updates are scheduled for Wednesday August 31.

Sales Tax Calculator Sales Tax Table. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. If you earn over 200000 youll also pay a 09 Medicare surtax.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. A breakdown of the City of Sacramento sales tax rate. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction.

The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. The Sacramento Sales Tax is collected by the merchant on all. The minimum combined 2022 sales tax rate for Sacramento California is.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Sacramento Sales Tax Rates for 2022. The December 2020 total local sales tax rate was also 8750.

All numbers are rounded in the normal fashion. Pacific time on August 31 or your draft will be deleted. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

This is the total of state county and city sales tax rates. You can view property information and estimate supplemental taxes. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the sales tax.

If you have a saved online draft application or renewal please submit it before 500 pm. This search tool is maintained by an independent data service. 100 Working Sacramento County sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. The current total local sales tax rate in Sacramento CA is 8750. The property tax rate in the county is 078.

Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate. Did South Dakota v.

Irs Tax Refund 2022 How To Calculate Your Refunds For This Year Marca

All About California Sales Tax Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Best Cheap Car Insurance In Sacramento Bankrate

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Transfer Tax Calculator 2022 For All 50 States

Capital Gains Tax What Is It And How To Calculate Marca

Irs Form 540 California Resident Income Tax Return

What A Full Time Equivalent Is And How To Calculate It

How To Calculate Cannabis Taxes At Your Dispensary

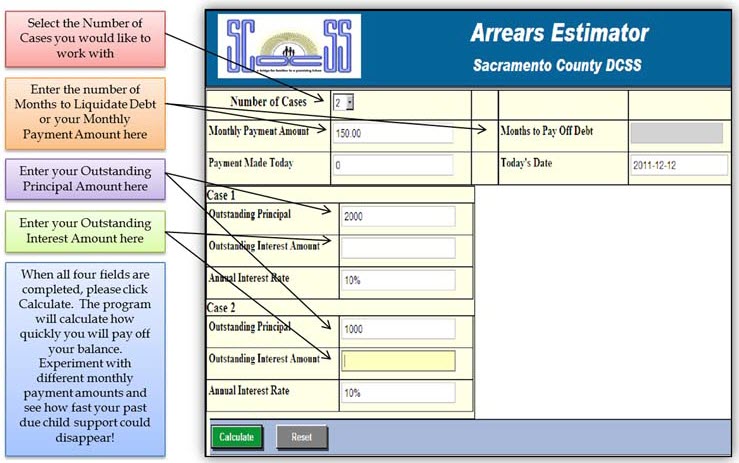

Child Support Estimator Clearance 55 Off Www Ingeniovirtual Com

Property Tax Calculator Casaplorer

How To Calculate Capital Gains Tax H R Block

California Paycheck Calculator Smartasset

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Cannabis Taxes At Your Dispensary

How Accurate Are Online Tax Calculators Incompass Tax Estate And Business Solutions Sacramento